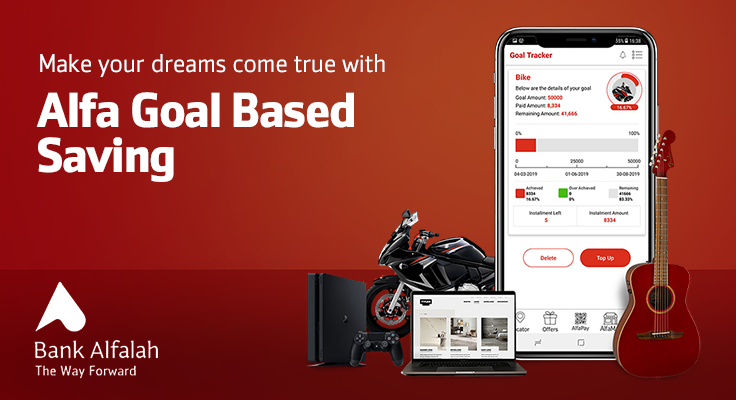

Dream it. Save for it. Live it: Ba-asani Alfa k sath

Ever had a goal to purchase a Mobile phone, Car, Xbox or plan any Vacation trip but couldn’t save for it? With Alfa Goal-Based Saving, set any customizable goal for a duration of 1 month – 12 months and let Alfa save for you with its Auto-Debit feature.

Product Features

| Customizable Goals | Bike, Car, Hajj, Umrah, Shadi, Education, Annual Vacation/Trip, or any Goal of your choice |

| Goal Amount | Rs 5,000 – Rs 500,000 |

| Goal Tenure (Duration) | 1 Month, 3 Months, 6 Months, 12 Months |

| Payment Options | Daily, Weekly, Fortnightly (every 2 weeks), Monthly |

| Debit Source | Bank Alfalah Account, Alfa Account (Wallet) |

| Free Insurance | 100% free insurance of the remaining goal instalments in case of accidental death or permanent disability |

| Auto-Debit | Automatic deductions of installments from the selected Account or Wallet, based on selected payment options |

| Goal Tracker | Track the status of your goals, payments made and remaining installments with their Timelines |

| Manual Top-ups | Manually pay your installments for early completing the goal |