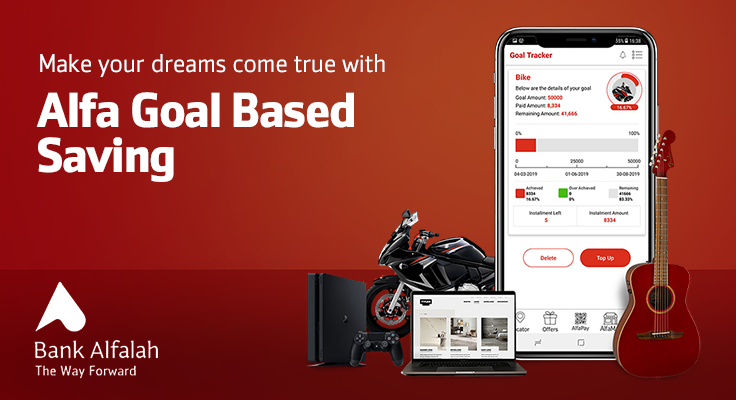

With Goal-Based saving, you can easily save towards your goals. First you set any desirable goal on Alfa for example Car, Bike, Child education, Hajj, Umrah, Vacations etc, then you enter a goal amount which is required to complete your goal, you select the duration to complete the goal and Alfa automatically deducts payments from your account with its Auto debit feature to help you complete the goal. Furthermore, you get free reminders of your payments due. 100% free insurance coverage is also given to customers for their remaining instalments of the goal.

You can create multiple goals and easily track their completion/ remaining instalments and manage them accordingly.