As part of its Roshan Digital Account (RDA) initiative, SBP continues to endeavor to provide a seamless banking experience and offer a variety of products and services, that make RDA a great value proposition for non-resident Pakistanis (NRPs). Among its myriad unique selling propositions and attractive investment avenues, are Naya Pakistan Certificates. These instruments offer lucrative and competitive returns that are designed to match the expectations of NRPs.

Following recent increases in the monetary policy rate, SBP is taking steps to ensure that NPCs remain a lucrative investment propositon for NRPs. To this end, SBP in coordination with the Ministry of Finance raised the rates of PKR denominated NPCs in September 2022. Due to this increase, the central bank has managed to reinvigorate the confidence of our Pakistani diaspora in RDA.

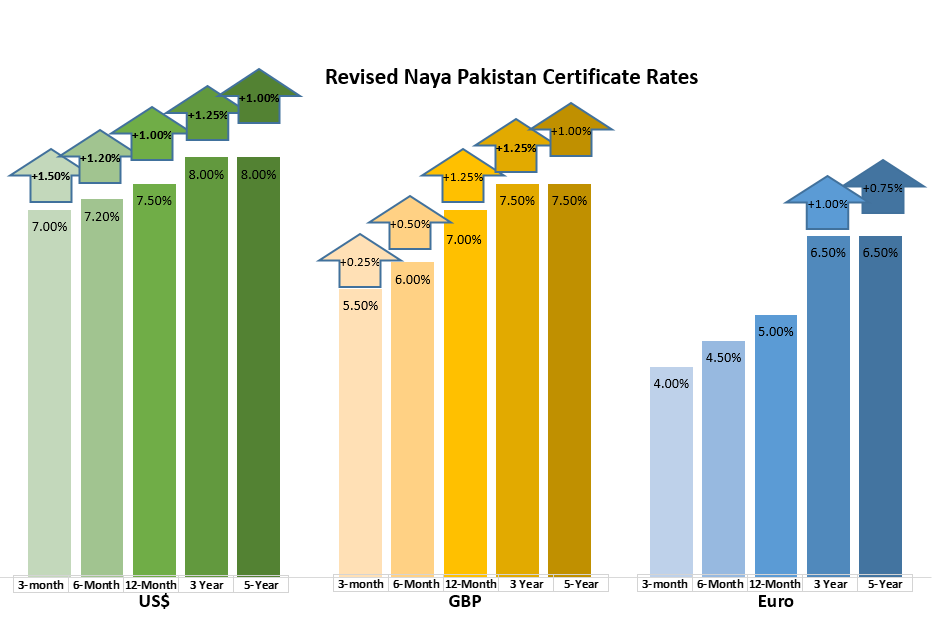

Subsequently, SBP coordinated with the Ministry of Finance to also revisit the rates of return on NPCs denominated in foreign currencies, to bring them in line with investment returns offered on other foreign currency instruments issued by the Government of Pakistan.

After detailed consultations and deliberations with stakeholders, including NRPs, the Ministry of Finance notified an increase in the rates of foreign currency denominated NPCs in January 2023. The Ministry of Finance has also decreased the minimum investment amount in these instruments as the majority of NRPs are from the blue-collar segment of the society and it was difficult for them to save the requisite amount to avail the benefits of NPCs.

The revision of NPC rates and the minimum investment amount in all currencies shows SBP’s resolve to continue to promote the RDA scheme. SBP remains committed to facilitating the Pakistani diaspora and increasing avenues for investment in the country.

(The bars show revised rates, whereas the arrows depict the absolute increase in rates.)