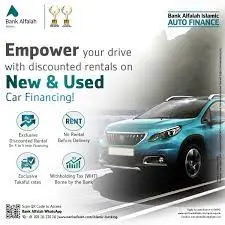

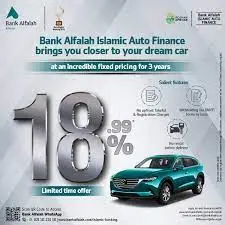

Bank Alfalah Islamic Auto Finance

Bank Alfalah Islamic Auto Finance lets you get the car of your choice. With simple, convenient and flexible solutions that are Shari’ah compliant.

- Choose locally manufactured/ assembled New or Used cars.

- Flexible tenure 1 to 5 years for vehicles up to 1000 CC (Upto 3 years for vehicles above 1000 CC).

- Security deposit is 30%

- No upfront Takaful charges.

- No upfront registration charges.

- No rentals before delivery of the vehicle.

- With-holding tax (WHT) shall be borne by the bank.

- Competitive pricing.

- Quick Processing time.

- Residual Value (RV) option to lower your monthly rentals.

Eligibility Criteria

- Pakistani.

- Minimum income requirement of Rs. 25,000/- per month (Salaried) and Rs. 50,000/- (Self-employed businessmen or professionals).

- Age limit-For salaried individuals: Minimum 21 years and maximum 60 years (govt. employees) and 65 years (private sector) at the time of maturity and

Age limit-For self-employed businessman/professional: Minimum 21 years and maximum 70 years at the time of maturity. - Years in employment:

Permanent employee: Currently employed with total employment experience of 3 months.

Contractual employee: Currently employed with total employment experience of 6 months.

Businessman / self-employed professional: Minimum 1 year in current business.

Fuel Your Drive Toyota

What's included?

- All Toyota Variant

- Preferred delivery

- Takaful rate 2.85% without tracker

- Security Deposit as low as 15%

*Terms & Conditions Apply